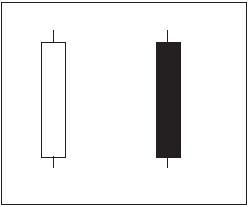

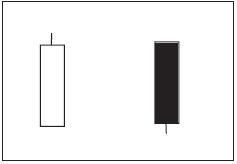

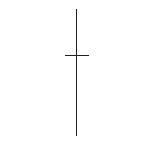

The Doji is also comprised of one candle. The Japanese say when a Doji occurs, one should always take notice. It is one of the most important Candlestick signals. The formation is created when the opening price and closing price are the same. This forms a horizontal line. The implication is that the bulls and the bears are in a state of indecision. It is an important alert at both the top and bottom of trends. At the top of a trend, the Doji signals a reversal without needing confirmation. The rule of thumb is that you should close a long or go short immediately.

However, the Doji occurring during the downtrend requires a bullish day to confirm the Doji day. The Japanese explanation is that the weight of the market can still force the trend downwards.

The Doji is an excellent example of the Candlestick method having superior attributes compared to the Western bar charting method. The deterioration of a trend is not going to be as apparent when viewing standard bar charts.

Criteria

1. The open and the close are the same or nearly the same.

2. The length of the shadow should not be excessively long, especially when viewed at the end of a bullish trend.

Signal Enhancements

1. A gap away from the previous day’s close sets up for a stronger reversal move.

2. Large volume on the signal day increases the chances that a blowoff day has occurred although it is not a necessity.

3. It is more effective after a long candle body, usually an exaggerated daily move compared to the normal daily trading range seen in the majority of the trend.

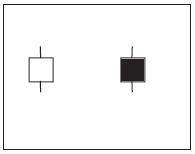

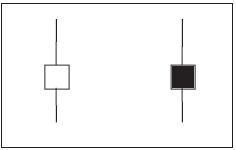

THE LONG LEGGED DOJI (JUJI)

The Long Legged Doji is comprised of long upper and lower shadows. The price opened and closed in the middle of the trading range. Throughout the day, the price moved up and down dramatically before it closed at or near the opening price. This reflects the great indecision that exists between the bulls and the bears. Juji means “cross.”

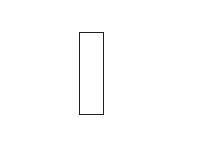

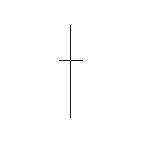

GRAVESTONE DOJI (TOHBA)

The Gravestone Doji is formed by the open and the close being at the low of the trading range. The price opens at the low of the day and rallies from there, but by the close the price is beaten back down to the opening price. The Japanese analogy is that it represents those who have

died in battle. The victories of the day are all lost by the end of the day. A Gravestone Doji, at the top of the trend, is a specific version of the Shooting Star. At the bottom, it is a variation of the Inverted Hammer. The Japanese sources claim that the Gravestone Doji can occur only on the ground, not in the air. This implication is that it works much better to show a bottom reversal than a top reversal. However, a Doji shows indecision no matter where it is found.

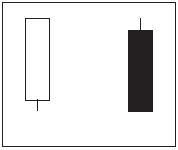

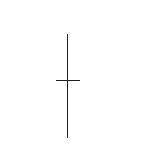

THE DOJI’S DRAGONFLY DOJI (TONBO)

The Dragonfly Doji occurs when trading opens, trades lower, and then closes at the open price that is the high of the day. At the top of the market, it becomes a variation of the Hanging Man. At the bottom of a trend, it becomes a specific Hammer. An extensively long shadow on a Dragonfly Doji at the bottom of a trend is very bullish. Dojis that occur in multiday patterns make those signals more convincing reversal signals.