It's almost the 3rd week I'm in Makati City, and the project is entering the most critical status. Our client already sniffed out that our product is not ready yet, and the bugs keep coming and coming into our bug trackers. There's no more fun and hang out in weekend coz the application teams must meet the (very crazy) deadline. No more Mr. Nice Guys even to the others internal teams and the heat keep rising and rising, after our CEO meet with our clients in Boards of Meeting and resulted that we must archive with no delay or this project will be TERMINATED.

Wow...its not a good record in my CV, but i have no choice. Actually not in my division thats on fire, coz i'm just handling only for the reporting, and the problem was in the applications it self. But still with the delay in the applications resulting in delay for report test, but the deadline keep on time. So when my report applications tested there's maybe not much time to me to fix the bugs...ow no.

Btw I'm still trying to keep it up with my friends to seek more technical analysis knowledge in stock markets, but since i'm working almost 12 hours everday (even on saturday) thats make me to postpone it :(. So many idea that i want to share in this blog but so litte time to write it...even for blogging myself :-(.

HELL MARCH

yeah...HELL MARCH....maybe the best phrase to describe my self right now. Just like one of the sound track in C&C Red Alert 2 by Frank Klepacki...

No more chatting in trading day, no more browsing for news. Just work...work...and work !!! passing this week with glory.

"Die Waffen – legt an!"

Thursday, February 28, 2008

Sunday, February 24, 2008

4P - Parabolic SAR

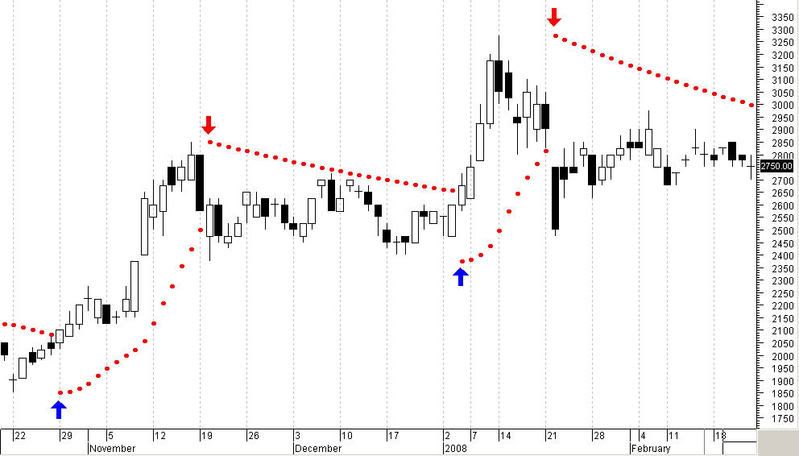

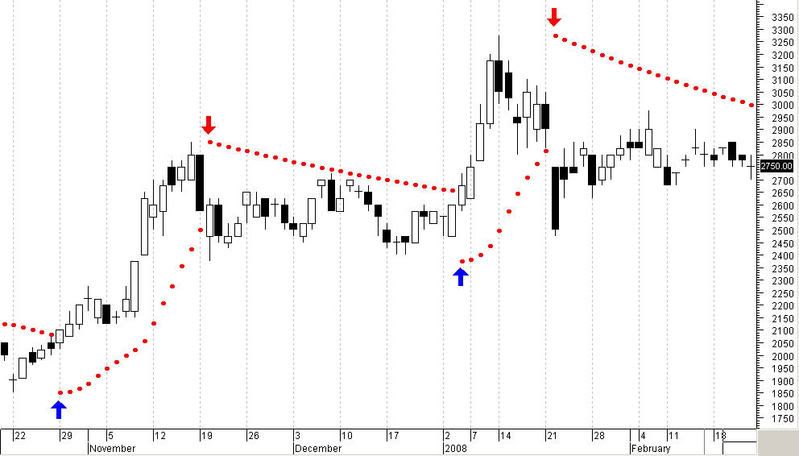

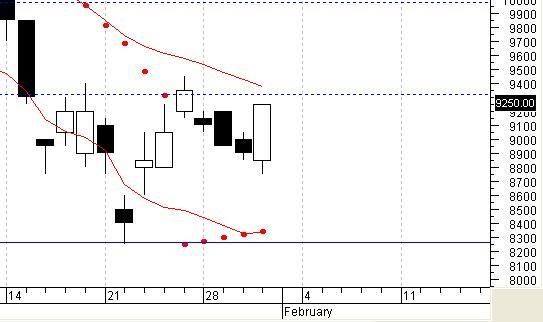

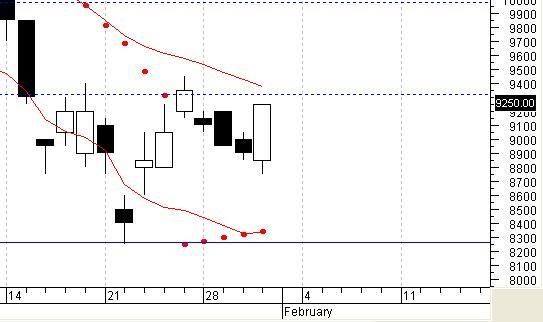

Parabolic SAR adalah salah satu indicator dalam 4P yang disarankan oleh Pak Vier. SAR disini adalah singkatan dari "Stop And Reversal", indicator ini dapat dikatakan merupakan indicator yang paling "terlambat" dalam memberikan signal, namun keterlambatan tersebut memberikan signal yang kuat apakah saham tersebut akan naik ataupun turun. Formula/rumusan untuk menciptakan Parabolic SAR dapat dikatakan komplek namun sangat mudah untuk menginterpretasikan indicator ini. Pada dasarnya indicator Parabolic SAR terdiri dari sekumpulan titik-titik yang disebut dengan "Trailing Stop". Pada saat trailing stop diatas harga suatu emiten dapat dikatakan emiten tersebut sedang mengalami penurunan, dan sebaliknya apabila trailing stop berada dibawah harga suatu emiten berarti emiten tersebut sedang mengalami kenaikan. Semakin menyempitnya jarak antara harga dengan trailing stop mengindikasikan kemungkinan besar perpindahan indicator baik dari atas ke bawah maupun dari bawah ke atas.

Dari gambar diatas dapat diliat harga mengalami kenaikan pada saat titik trailing stop berada dibawah harga, dan mulai berbalik arah pada saat titik mulai menyempit mendekati harga.

Dari gambar diatas dapat diliat harga mengalami kenaikan pada saat titik trailing stop berada dibawah harga, dan mulai berbalik arah pada saat titik mulai menyempit mendekati harga.

Monday, February 18, 2008

A Week Down, 7 More To Go

Fiuh….a week down, but there’s 7 more to go. Nothing much I can explore Philippines since the I live in Makati Indonesia Indonesia

In the last week, most of the time was spend in the office, I woke up every day 8 am (Philippines Time) and then have a peanut butter sandwich or blubbery sandwich 2 slices and then start to go to shower. The office was maybe 4 or 5 block from the apartment, we go the the office on foot. Every lunch time I always trying a different kind of meals that I cant find inIndonesia

Last Friday (15/02/2008) there is a demonstrations in front of our office, I think its about the president ofPhilippines

Check here for the demonstrations its all about here

In the last week, most of the time was spend in the office, I woke up every day 8 am (Philippines Time) and then have a peanut butter sandwich or blubbery sandwich 2 slices and then start to go to shower. The office was maybe 4 or 5 block from the apartment, we go the the office on foot. Every lunch time I always trying a different kind of meals that I cant find in

Last Friday (15/02/2008) there is a demonstrations in front of our office, I think its about the president of

Check here for the demonstrations its all about here

To bad I still cant upload the pictures, I’ll upload it after I find a decent connections or an internet caffee around here. That’s all for now….i’ll try to update it again next week.

Saturday, February 09, 2008

Good Bye Jakarta, Mabuhay Manila

On the 9th feb 08, i'm leaving Indonesia and travel to manila for company project in the BPI (Bank of Philipine Islands). This is the first time i'm heading to manila, I'm already packed since friday (8 feb) to make sure i bring all the needed stuff. Thanks to my girl for the baggage so I can manage only bring 1 baggage rather than 2. After i kiss my girl and jump off to my cab. Like usual no bad/unhappy feeling i felt.

In the airport, after meeting with my friend cecilia. we start to check in. 1st we check in out baggage and pay the fiscal fee (fiskal), after that we start to the counter for fiscal check and imigrations, right after we pass the imigrations check i heard that our flight already boarding, so we hurry to go to the waiting room .

We flight in the right time at 13:35. our first lunch was opor ayam :) to bad i can manage to take a picture on our lunch, after one hour and a half we arrived in Changi airport, its just a short transit, no more than 1 hours so we cant go around the airport. After we boarding heading to Manila, yeah we got the 2nd meal not long before the 1st meal. The 2nd meal was spaghetti with cheese :)

We arrive at Ninoy Aquino Airport at 7:00 PM, and straight to the immigrations after passing the bird flu control and i see Indonesian people :p ..... that was Ferry and Andy to help me out to the apartment. After a little incident we almost took the wrong taxi route (fiuh....) and Pinoy taxi drivers just like a F1 racing driver :D

Day 1 after unload my baggage...me and Andi & Mr Chairil walking around the block. My 1st impression about Philipines was...Clean, Tidy, and Clear. We walking around the city park...wow i feel the clean air just like in the mountains, also the pedestrians was tidy and comfortable, even when we walk after past midnight. I hope Jakarta can be like this...at least...

Ahh to bad my pda cant online automatically :( i think its need at least 2 day to make my international roaming active.

Day 2 its sunday...we going to SM Mall of Asia...its a very large mall, i think like Kelapa Gading Mall if is it in Indonesia. Hmm not too interesting i think...just like ordinary mall with expensive stuff (than in Indonesia). Except it has Bay View so we can see the open sea directly. The 1st dinner in Mall of Asia was PorkChop BBQ, its a pork bbq with salt ketchup...i will post the pic after im back in Indonesia (hahaha maybe 2 month later) coz the internet connections here soo bad. After buying a plug for my laptop charger (coz the plug is different here) and buy some ice-cream...we back to our apartment, like before...we use F1 Taxi Cab :D

In the airport, after meeting with my friend cecilia. we start to check in. 1st we check in out baggage and pay the fiscal fee (fiskal), after that we start to the counter for fiscal check and imigrations, right after we pass the imigrations check i heard that our flight already boarding, so we hurry to go to the waiting room .

We flight in the right time at 13:35. our first lunch was opor ayam :) to bad i can manage to take a picture on our lunch, after one hour and a half we arrived in Changi airport, its just a short transit, no more than 1 hours so we cant go around the airport. After we boarding heading to Manila, yeah we got the 2nd meal not long before the 1st meal. The 2nd meal was spaghetti with cheese :)

We arrive at Ninoy Aquino Airport at 7:00 PM, and straight to the immigrations after passing the bird flu control and i see Indonesian people :p ..... that was Ferry and Andy to help me out to the apartment. After a little incident we almost took the wrong taxi route (fiuh....) and Pinoy taxi drivers just like a F1 racing driver :D

Day 1 after unload my baggage...me and Andi & Mr Chairil walking around the block. My 1st impression about Philipines was...Clean, Tidy, and Clear. We walking around the city park...wow i feel the clean air just like in the mountains, also the pedestrians was tidy and comfortable, even when we walk after past midnight. I hope Jakarta can be like this...at least...

Ahh to bad my pda cant online automatically :( i think its need at least 2 day to make my international roaming active.

Day 2 its sunday...we going to SM Mall of Asia...its a very large mall, i think like Kelapa Gading Mall if is it in Indonesia. Hmm not too interesting i think...just like ordinary mall with expensive stuff (than in Indonesia). Except it has Bay View so we can see the open sea directly. The 1st dinner in Mall of Asia was PorkChop BBQ, its a pork bbq with salt ketchup...i will post the pic after im back in Indonesia (hahaha maybe 2 month later) coz the internet connections here soo bad. After buying a plug for my laptop charger (coz the plug is different here) and buy some ice-cream...we back to our apartment, like before...we use F1 Taxi Cab :D

Friday, February 08, 2008

Rooster In The Year Of Rat

2008 Predictions for Rooster

2008 Predictions for RoosterFrom Molly Hall,

Protect the savings you have worked so hard to store up. The Rat does not dislike you, but has little time this year to while away in your company. Cut back on extravagances. Stop thinking you can just blithely fly off any old where, spend a few days enjoying yourself in Paris or Marrakech or Bali and still be able to make those car payments. You Roosters are not very flexible and tend to crowd yourselves into a corner. If you’re working, then the job becomes the only thing you can think about or do. You obsess, overwork and can burn out very quickly. Then, of course, you feel sorry for yourself and decide that you are owed a break. But once again, instead of just lying down and reading a fat novel for a couple of days at home, you must move about. So you jet off to just the place you fancy with just the right climate and the tastiest food and the best people. Then, as soon as you are there, you start shopping up all the money you earned whilst overworking and burning out. Is this beginning to sound like a pattern?

Well, the Rat year is a good year for you Rooster people . . . but only if you break this madcap pattern of yours and espouse rest and relaxation in your own surroundings. Sit still for heaven’s sake. Welcome the opportunities that waft your way. Of course, if you are never at home, you won't be there to receive them, will you? There are movements afoot in your career which can set certain things to rights that may have gone awry in the past. You want out of something. You have finished a portion of your existence in a job or a business or even in a relationship and you want to see that engagement come to an end. The currents in the work place are flowing in the direction you need right now. But if you keep fleeing the work place and ignoring those subtle changes, you may miss the boat.

The changes may take a few months to hatch. So to distract yourself from the tedium you so fear, take breaks during the day. Go for a big walk. Get thee to the gym or to tai chi or yoga classes. Meditate. Take Pilates classes. And instead of squandering your hard-earned burnout cash on air travel and wine, put a bunch away in the bank and let it earn you some interest. The message? Slow down, kick back and thrive. Keep on racing breakneck willy nilly and you will live to rue the day.

About.com

Thursday, February 07, 2008

IPO ELNUSA (ELSA)

Setelah malam sebelum IPO dibicarakan di chatroom, dengan full keyakinan ELSA dapat membantu mengerek IDX keluar dari jurang berdarah, karena sebelumnya hampir semua market regional merah. Pada penawaran awal ELSA di jual di harga 400 - 450.

Saat pre-opening ELSA tidak bisa dipesan karena bid offer masih 0, kemudian sesaat sebelum opening sepertinya sudah bisa input transaksi dengan harga bid offer masih diposisi 0, namun bisa order. Sepertinya ini salah satu cara untung mengetahui sampai seberapa tinggi buyer berani melakukan bid. Keadaan ini tidak berlangsung lama, saat opening harga berubah dengan sangat cepat dari 450, 470, kemudian 490, 495 trus naek. Kebodohan pertama adalah tidak berani untuk membid lebih tinggi misalnya kenaikan 10 perak secara langsung , ditambah software yang nge lag

, ditambah software yang nge lag  membuat order telat trus. Lebih baik apabila mengincar saham IPO, langsung ke gallery saja ! lebih pasti

membuat order telat trus. Lebih baik apabila mengincar saham IPO, langsung ke gallery saja ! lebih pasti

Satu lagi yang menarik, saat jam² genting banyak OLT yang nge hang tidak bisa order ELSA dan tiba² broker menawarkan bantuan untuk dilakukan di floor secara langsung...cukup generous dan tanpa pikir panjang sikat di harga yang sudah diatas 500, tapi tidak lama harga mulai turun sampai 505 kemudian bergerak di kisaran 510 - 515 dari jam 11 hingga akhir penutupan.

Ada yang skeptis dengan fenomena ini dan menganggap sekuritas tidak memihak client, dan hanya mementingkan diri sendiri. Karena bisa saja sekuritas tersebut borong terlebih dahulu waktu harga masih rendah (awal pembukaan) kemudian disaat sudah mulai timbul untung mulai disebar² kan ke client nya. Namun bisa dilihat dari sisi positif artinya "Azas praduga tak bersalah" kita harus mengambil hikmahnya. Berikut langkah dalam mengincar saham² IPO agar bisa lebih sukses lagi

Saat pre-opening ELSA tidak bisa dipesan karena bid offer masih 0, kemudian sesaat sebelum opening sepertinya sudah bisa input transaksi dengan harga bid offer masih diposisi 0, namun bisa order. Sepertinya ini salah satu cara untung mengetahui sampai seberapa tinggi buyer berani melakukan bid. Keadaan ini tidak berlangsung lama, saat opening harga berubah dengan sangat cepat dari 450, 470, kemudian 490, 495 trus naek. Kebodohan pertama adalah tidak berani untuk membid lebih tinggi misalnya kenaikan 10 perak secara langsung

, ditambah software yang nge lag

, ditambah software yang nge lag  membuat order telat trus. Lebih baik apabila mengincar saham IPO, langsung ke gallery saja ! lebih pasti

membuat order telat trus. Lebih baik apabila mengincar saham IPO, langsung ke gallery saja ! lebih pasti

Satu lagi yang menarik, saat jam² genting banyak OLT yang nge hang tidak bisa order ELSA dan tiba² broker menawarkan bantuan untuk dilakukan di floor secara langsung...cukup generous dan tanpa pikir panjang sikat di harga yang sudah diatas 500, tapi tidak lama harga mulai turun sampai 505 kemudian bergerak di kisaran 510 - 515 dari jam 11 hingga akhir penutupan.

Ada yang skeptis dengan fenomena ini dan menganggap sekuritas tidak memihak client, dan hanya mementingkan diri sendiri. Karena bisa saja sekuritas tersebut borong terlebih dahulu waktu harga masih rendah (awal pembukaan) kemudian disaat sudah mulai timbul untung mulai disebar² kan ke client nya. Namun bisa dilihat dari sisi positif artinya "Azas praduga tak bersalah" kita harus mengambil hikmahnya. Berikut langkah dalam mengincar saham² IPO agar bisa lebih sukses lagi

- Langsung ke gallery !

- Perhatikan baik² apabila kenaikan sudah melebihi 30 - 50%

Wednesday, February 06, 2008

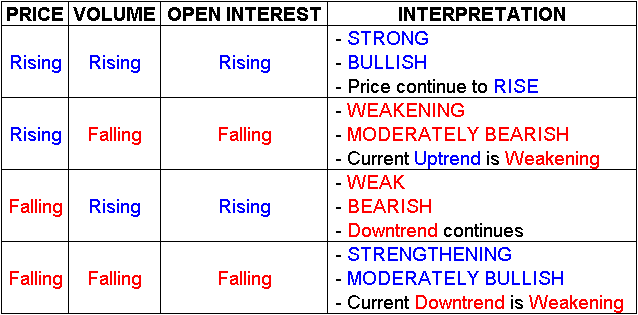

Market Interpretation

Check List for Chartist

Complete this checklist before you go to the floor

- 4P - Bollinger Band

- 4P - Parabolic SAR

- 4P - MACD

- 4P - Volume

- Moving Average (20,30,60)

- Chart Pattern

- Candlesticks

- 4 Siklus

Monday, February 04, 2008

4P - Bollinger Band

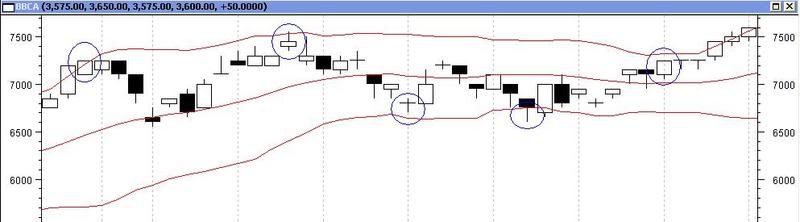

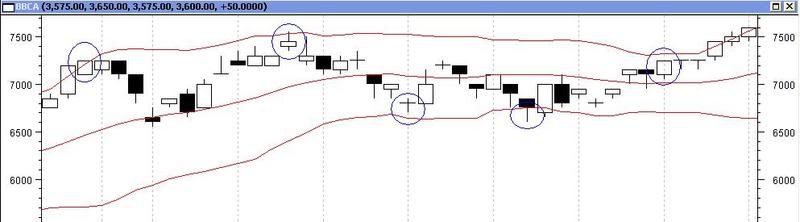

Bollinger Band (BB) adalah salah satu indicator yang paling populer dalam Technical Analysis. BB terdiri dari moving average dan standard deviasi. Moving average adalah garis yang terletak di tengah BB sedangkan standard deviasi nya terbagi jadi 2 yaitu upper band dan lower band. Berikut penjelasan mengenai tiap² bagian :

Bollinger Band Indicator

Bollinger Band Indicator

- Moving Average : Adalah garis ditengah indicator yang menunjukan pergerakan rata saham tersebut, biasa nya menggunakan metode Simple Moving Average periode 20 hari (SMA20)

- Upper Band : Adalah garis yang dibuat dengan menambahkan 2 standard deviasi diatas moving average

- Lower Band : Adalah garis yang dibuat dengan mengurasi 2 standard deviasi diatas moving average

Bollinger Band Indicator

Bollinger Band IndicatorDari contoh diatas dapat disimpulkan :

Buy Signal adalah saat harga sudah mencapai/dibawah lower band

Sell Signal adalah saat harga sudah mencapai/diatas upper band

untuk pemain yg konservatif lebih memilih saat harga mencapai upper/lower band sebagai signal dibandingkan menunggu sampai melewati garis tersebut.

Bollinger Band Breakouts

Buy Signal : Saat resistance line dilewatin dan mulai menyentuh bibir atas BB

Buy Signal : Saat resistance line dilewatin dan mulai menyentuh bibir atas BB

Sell Signal : Saat support line dilewatin dan mulai menyentuh bibir bawah BB

Bollinger Band As Trend Indicator

Bollinger Band juga dapat digunakan untuk menentukan arah dan seberapa kuat kecenderungan trend tersebut

Contoh saham CPIN cenderung bergerak diantara upper band dan SMA. Selain itu SMA digunakan layaknya level support bagi saham tersebut. Begitu pula sebaliknya.

Contoh saham CPIN cenderung bergerak diantara upper band dan SMA. Selain itu SMA digunakan layaknya level support bagi saham tersebut. Begitu pula sebaliknya.

Kontraksi & Volatilitas

Kontraksi (lebar/sempitnya) upper band dengan lower band disebabkan oleh volitilitas dari saham tersebut, semakin volatile maka BB akan cenderung melebar dan sebaliknya akan menyempit apabila volitilitas mulai berkurang.

Double Bottom Buy / Double Top Sell

Double Bottom Buy : Terjadi saat harga menekan lower band namun tidak sampai menembus bibir BB bawah, merupakan signal buy. Signal ini menjadi kurang valid apabila harga menembus hingga dilbawah bibir BB

Double Top Sell : Terjadi saat harga menyentuh upper band namun tidak sampai melampaui bibir BB atas, merupakan signal sell. Signal ini menjadi kurang valid apabila harga melampaui hingga dilbawah bibir BB

Walaupun Bollinger Band dapat membantu memberikan signal buy/sell, BB tidak di-design untuk menentukan arah pergerakan suatu saham. 2 fungsi utama BB adalah

update : 28 feb 2008 - vierjamal.blogspot.com

Bollinger Band & SMA21

Apabila pasar sedang bullish maka Bollinger Band atas akan menjauh dari SMA 21 hari dan bila pasar sedang bearish maka bollinger band atas cenderung mendekati SMA 21 hari. Deviasi antara Bolinger Band atas dan bawah terbentuk karena adanya perubahan harga dan volume dan setiap trader harus memperhatikan bollinger band karena hal ini sangat mendasar sebelum membuat analisa teknis. Pada saat melihat chart pertama kali maka anda harus melihat apakah saat ini pergerakan harga diatas SMA21 ataukah dibawah SMA21 karena secara teknis ini sangat penting sekali dalam menentukan strategi anda dalam transaksi, apakah chopy trade, short ataukah long swing trade.

Disadur dari :

OnlineTradingConcepts.com

Vierjamal.blogspot.com

StockCharts.com

Buy Signal adalah saat harga sudah mencapai/dibawah lower band

Sell Signal adalah saat harga sudah mencapai/diatas upper band

untuk pemain yg konservatif lebih memilih saat harga mencapai upper/lower band sebagai signal dibandingkan menunggu sampai melewati garis tersebut.

Bollinger Band Breakouts

Breakouts terjadi setelah periode consolidation, ketika harga mendekati bibir BB. Untuk menentukan breakouts akan lebih mudah bila menggunakan indicator tambahan seperti indicator Support & Resistance.

Buy Signal : Saat resistance line dilewatin dan mulai menyentuh bibir atas BB

Buy Signal : Saat resistance line dilewatin dan mulai menyentuh bibir atas BBSell Signal : Saat support line dilewatin dan mulai menyentuh bibir bawah BB

Bollinger Band As Trend Indicator

Bollinger Band juga dapat digunakan untuk menentukan arah dan seberapa kuat kecenderungan trend tersebut

Contoh saham CPIN cenderung bergerak diantara upper band dan SMA. Selain itu SMA digunakan layaknya level support bagi saham tersebut. Begitu pula sebaliknya.

Contoh saham CPIN cenderung bergerak diantara upper band dan SMA. Selain itu SMA digunakan layaknya level support bagi saham tersebut. Begitu pula sebaliknya.Kontraksi & Volatilitas

Kontraksi (lebar/sempitnya) upper band dengan lower band disebabkan oleh volitilitas dari saham tersebut, semakin volatile maka BB akan cenderung melebar dan sebaliknya akan menyempit apabila volitilitas mulai berkurang.

Double Bottom Buy / Double Top Sell

Double Bottom Buy : Terjadi saat harga menekan lower band namun tidak sampai menembus bibir BB bawah, merupakan signal buy. Signal ini menjadi kurang valid apabila harga menembus hingga dilbawah bibir BB

Double Top Sell : Terjadi saat harga menyentuh upper band namun tidak sampai melampaui bibir BB atas, merupakan signal sell. Signal ini menjadi kurang valid apabila harga melampaui hingga dilbawah bibir BB

Walaupun Bollinger Band dapat membantu memberikan signal buy/sell, BB tidak di-design untuk menentukan arah pergerakan suatu saham. 2 fungsi utama BB adalah

- Untuk menunjukan periode dengan volitilitas tinggi atau rendah

- Untuk menunjukan periode dimana harga sudah mendekati titik tertinggi/terendah dan cenderung labil

update : 28 feb 2008 - vierjamal.blogspot.com

Bollinger Band & SMA21

Apabila pasar sedang bullish maka Bollinger Band atas akan menjauh dari SMA 21 hari dan bila pasar sedang bearish maka bollinger band atas cenderung mendekati SMA 21 hari. Deviasi antara Bolinger Band atas dan bawah terbentuk karena adanya perubahan harga dan volume dan setiap trader harus memperhatikan bollinger band karena hal ini sangat mendasar sebelum membuat analisa teknis. Pada saat melihat chart pertama kali maka anda harus melihat apakah saat ini pergerakan harga diatas SMA21 ataukah dibawah SMA21 karena secara teknis ini sangat penting sekali dalam menentukan strategi anda dalam transaksi, apakah chopy trade, short ataukah long swing trade.

Disadur dari :

OnlineTradingConcepts.com

Vierjamal.blogspot.com

StockCharts.com

TLKM Mid Day

Pagi ini dapat info mengenai rencana TLKM untuk buyback saham lagi, TLKM dibuka di harga 9400 artinya open = last day high, berarti skenario kemarin tidak ada yang masuk

Pergerakan TLKM hari ini menanjak naik hingga 9700...to bad, keluar di 9500.

But for today...cukup menyenangkan lah, i'm better get back to my real job...

2 week remaining to Philipines...

Pergerakan TLKM hari ini menanjak naik hingga 9700...to bad, keluar di 9500.

But for today...cukup menyenangkan lah, i'm better get back to my real job...

2 week remaining to Philipines...

Sunday, February 03, 2008

Analisis TLKM Senin 4 Feb

How Low Can You Go ???

Chart : Click Here

Pada tgl 1 feb, TLKM sempat menembus harga tertinggi 9400...another good lesson, seharusnya setelah melihat trend TLKM yang kurang bagus, langsung set sell di 9350/9400 dan terbebas dari beban spt skr

dan terbebas dari beban spt skr  seperti melihat pintu neraka tapi tidak bisa mundur/berputar arah

seperti melihat pintu neraka tapi tidak bisa mundur/berputar arah

Ok...jangan terlalu dipikirkan, nasi sudah menjadi bubur. Lebih baik dipikirkan exit strategy nya. Agar tidak terlalu babak belur . Pertama yang perlu diperhatikan adalah...formasi terakhir candlestick adalah doji, dimana apabila doji terbentuk setelah uptrend, dpt dipastikan akan mengalami koreksi tanpa perlu konfirmasi lagi (click here).

. Pertama yang perlu diperhatikan adalah...formasi terakhir candlestick adalah doji, dimana apabila doji terbentuk setelah uptrend, dpt dipastikan akan mengalami koreksi tanpa perlu konfirmasi lagi (click here).

Sekarang kita kembali melihat kebelakang bagaimana sejarah TLKM saat mengalami hal seperti ini yaitu Doji di level fibo rebound 23.6% pada tanggal 05/28/2007, keesokan harinya harga dibuka sama dengan penutupan kemaren (open = last day close)...dan hasilnya BLACK OPENING MARUBOZU

kemudian kita liat lagi tgl 06/06/2007, keesokan hari harga dibuka sama sama dengan harga terendah sebelumnya (open = last day low) alhasil ditutup dengan harga tertinggi kemarin .

.

get the point ??

Dalam dunia saham dipercaya dan terbukti kalau "SEJARAH BERULANG". Namun untuk kasus ini saat di trace back hingga juni 2005 tidak ditemukan (Doji di level fibo rebound 23.6%)

(Doji di level fibo rebound 23.6%)

Beberapa indicator tidak menunjukan signal yang bagus. Paling atas adalah Stochastic Oscilator yang tidak memberikan signal buy/sell karena walaupun berpotongan namun masih di area antara 20 - 80, kedua adalah MACD sudah memotong 2 hari yang lalu, BB menunjukan tanda-tanda mengerut dan sudah ada 4 titik PSAR dibawah.

Jujur i have no clue for this, dan hanya akan berpegangan pada candlestick. hope for the best !

Chart : Click Here

Pada tgl 1 feb, TLKM sempat menembus harga tertinggi 9400...another good lesson, seharusnya setelah melihat trend TLKM yang kurang bagus, langsung set sell di 9350/9400

dan terbebas dari beban spt skr

dan terbebas dari beban spt skr  seperti melihat pintu neraka tapi tidak bisa mundur/berputar arah

seperti melihat pintu neraka tapi tidak bisa mundur/berputar arah

Ok...jangan terlalu dipikirkan, nasi sudah menjadi bubur. Lebih baik dipikirkan exit strategy nya. Agar tidak terlalu babak belur

. Pertama yang perlu diperhatikan adalah...formasi terakhir candlestick adalah doji, dimana apabila doji terbentuk setelah uptrend, dpt dipastikan akan mengalami koreksi tanpa perlu konfirmasi lagi (click here).

. Pertama yang perlu diperhatikan adalah...formasi terakhir candlestick adalah doji, dimana apabila doji terbentuk setelah uptrend, dpt dipastikan akan mengalami koreksi tanpa perlu konfirmasi lagi (click here).Sekarang kita kembali melihat kebelakang bagaimana sejarah TLKM saat mengalami hal seperti ini yaitu Doji di level fibo rebound 23.6% pada tanggal 05/28/2007, keesokan harinya harga dibuka sama dengan penutupan kemaren (open = last day close)...dan hasilnya BLACK OPENING MARUBOZU

kemudian kita liat lagi tgl 06/06/2007, keesokan hari harga dibuka sama sama dengan harga terendah sebelumnya (open = last day low) alhasil ditutup dengan harga tertinggi kemarin

.

.get the point ??

Dalam dunia saham dipercaya dan terbukti kalau "SEJARAH BERULANG". Namun untuk kasus ini saat di trace back hingga juni 2005 tidak ditemukan

(Doji di level fibo rebound 23.6%)

(Doji di level fibo rebound 23.6%)Beberapa indicator tidak menunjukan signal yang bagus. Paling atas adalah Stochastic Oscilator yang tidak memberikan signal buy/sell karena walaupun berpotongan namun masih di area antara 20 - 80, kedua adalah MACD sudah memotong 2 hari yang lalu, BB menunjukan tanda-tanda mengerut dan sudah ada 4 titik PSAR dibawah.

Jujur i have no clue for this, dan hanya akan berpegangan pada candlestick. hope for the best !

Saturday, February 02, 2008

Counter Strike 1.6 Freak !

Hi...

just for your informations, I'm a Counter Strike 1.6 Freaks

I'm playing counter strike almost from 7 year ago, back when CS still version 1.1 . Yeah...i know bunny jumping is cool, but I'm never like it coz its soo unrealistic

Back when i'm in the college, a good friend of mine Edo take to a internet caffee called Winner and introducing me to this game...at first i thought this game is to complicated, fast paced and i'm not familiar with the keys or command...but i dont know how...i'm become addicted

since then...I'm become a regular visitor at Winner, even without Edo...i'm always sit in the PC number 8 coz in that place nobody can see my monitor so i can play more calm (I hate when people see my monitor). I'm play everyday almost 8 - 12 hours per day, and i'm always become a top rank

In college, i remember when our gank introduced to CS by Hans (YM:elendermist) we always play after class but not last for long ...and a good friend of mine HERI (YM:elmo_rockstyle) that very obsessed with CS, we always wandering from one caffee to another to seek blood

...and a good friend of mine HERI (YM:elmo_rockstyle) that very obsessed with CS, we always wandering from one caffee to another to seek blood  (challenge) and often skip class only for playing in one caffee that wee believe some leet player that always play there, the caffee called Champion.

(challenge) and often skip class only for playing in one caffee that wee believe some leet player that always play there, the caffee called Champion.

I'm remember back when CS came out with the biggest changes that bunny hop is not allowed anymore, Winner owners wont upgrade the CS server to 1.4 coz he's affraid the customer will move to another caffee, but i'm able to make him upgrade it also i'm in become his trusted assistant. I play for FREE but in return i must help him to install all game in his pc, manage the networks, and also helping him choose the right VGA card for his caffee.

also i'm in become his trusted assistant. I play for FREE but in return i must help him to install all game in his pc, manage the networks, and also helping him choose the right VGA card for his caffee.

I remember when clan war was booming back in 2001/2002 i'm playing with some of good players like Hendrik (HZ), Laury (fin), Alex (dor), and Kuda ....i think they are the best in gaming specially CS. Also the 2nd generation like Alam, Itak (Baba Liong), and other leet player from Winner. Yeah I miss the good old days...when we always play together, laugh and just hanging around together

....i think they are the best in gaming specially CS. Also the 2nd generation like Alam, Itak (Baba Liong), and other leet player from Winner. Yeah I miss the good old days...when we always play together, laugh and just hanging around together

Now? I'm still the BEST !!! but i'm only play in public server, i think HZ and fin still play for tournament, ahh...also Hans...a good friend back when i'm still living in Alfa Indah. What? you want prove ???? here the screenshot

So...meet me in Vivagamers server pub-2. I'm always play there with some good player like baby_vegeta, TeQuiLa, CinHan, chen hau nan, Mafia_Hungsing, and much more...

Lock And Load

just for your informations, I'm a Counter Strike 1.6 Freaks

I'm playing counter strike almost from 7 year ago, back when CS still version 1.1 . Yeah...i know bunny jumping is cool, but I'm never like it coz its soo unrealistic

Back when i'm in the college, a good friend of mine Edo take to a internet caffee called Winner and introducing me to this game...at first i thought this game is to complicated, fast paced and i'm not familiar with the keys or command...but i dont know how...i'm become addicted

since then...I'm become a regular visitor at Winner, even without Edo...i'm always sit in the PC number 8 coz in that place nobody can see my monitor so i can play more calm (I hate when people see my monitor). I'm play everyday almost 8 - 12 hours per day, and i'm always become a top rank

In college, i remember when our gank introduced to CS by Hans (YM:elendermist) we always play after class but not last for long

...and a good friend of mine HERI (YM:elmo_rockstyle) that very obsessed with CS, we always wandering from one caffee to another to seek blood

...and a good friend of mine HERI (YM:elmo_rockstyle) that very obsessed with CS, we always wandering from one caffee to another to seek blood  (challenge) and often skip class only for playing in one caffee that wee believe some leet player that always play there, the caffee called Champion.

(challenge) and often skip class only for playing in one caffee that wee believe some leet player that always play there, the caffee called Champion.I'm remember back when CS came out with the biggest changes that bunny hop is not allowed anymore, Winner owners wont upgrade the CS server to 1.4 coz he's affraid the customer will move to another caffee, but i'm able to make him upgrade it

also i'm in become his trusted assistant. I play for FREE but in return i must help him to install all game in his pc, manage the networks, and also helping him choose the right VGA card for his caffee.

also i'm in become his trusted assistant. I play for FREE but in return i must help him to install all game in his pc, manage the networks, and also helping him choose the right VGA card for his caffee.I remember when clan war was booming back in 2001/2002 i'm playing with some of good players like Hendrik (HZ), Laury (fin), Alex (dor), and Kuda

....i think they are the best in gaming specially CS. Also the 2nd generation like Alam, Itak (Baba Liong), and other leet player from Winner. Yeah I miss the good old days...when we always play together, laugh and just hanging around together

....i think they are the best in gaming specially CS. Also the 2nd generation like Alam, Itak (Baba Liong), and other leet player from Winner. Yeah I miss the good old days...when we always play together, laugh and just hanging around together

Now? I'm still the BEST !!! but i'm only play in public server, i think HZ and fin still play for tournament, ahh...also Hans...a good friend back when i'm still living in Alfa Indah. What? you want prove ???? here the screenshot

So...meet me in Vivagamers server pub-2. I'm always play there with some good player like baby_vegeta, TeQuiLa, CinHan, chen hau nan, Mafia_Hungsing, and much more...

Lock And Load

Friday, February 01, 2008

ANTM Menuju 4000

Rencana awal pagi ini sebenarnya tidak mau trading...seharusnya support di ABN Amro, tapi saat melongok keluar jendela hujan deras sekali :( jadi males ngantor juga. Sambil baca² mailing list melihat index regional hijau. Sesi pembukaan ANTM kembali top volume. Sebelum nya target plan ambil TLKM karena bbrp hari ini banyak sentimen positif dan TLKM kemarin ditutup closing marubozu, diketahui pula support TLKM di 8800 sudah teruji dan terbukti ;)

TLKM - BAD MOVE !!!

Jujur gw hanya pengandalkan teori "Buy On Rumors, Sell On News" + volume, jadi pre-opening

langsung sikat TLKM based on rumors, kemudian liat ANTM langsung memimpin volume

sikat pula dengan full limit komposisi 70% TLKM 30% ANTM.

why bad move ?? check the chart !!

keliatan sekali tgl 1/25/2008 TLKM mencoba untuk keluar dari fibo rebound level 23.6% dan yang terjadi adalah gagal total...kalo dilihat kebelakang lagi...terlihat 23.6% itu sepertinya susah untuk dilewati. Memang betul opening TLKM langsung gap up di 9300 artinya tepat di level 23.6%, seharusnya saat itu jgn langsung hajar kanan, tapi perhatikan dahulu apakah sentimen pasar bisa menahan di angka tersebut sampai kira² 30 menit kedepan.

ANTM - VOLUME

sekali lagi Volume memang tidak pernah bohong ;) setelah kemarin BUMI sekarang ANTM dengan volume yang cukup besar, ditambah baru saja ngelirik milis ada berita Lap Keu ANTM menambah kecepatan akselerasi kenaikan ANTM. Hari ini netting 3725 - 3850 sesi 1. Di sesi 2 ga mau ambil resiko karena laporan inflasi Indonesia akan dikeluarkan BI. Betul...saat berita tersebut keluar dan meleset dari prediksi hingga 0.6% index langsung anjlok hingga -13, tapi kejadian penurunan itu hanya seperti shock therapy saja...index melangsungkan rally nya hingga di tutup menguat tipis ;). Menguatnya index dibantu oleh sentimen pasar terharap ANTM yang trus di buru oleh buyer...hingga mencapai 3900.

FENOMENA INCO

Lucu sekali, saat menjelang penutupan. saham INCO tiba² melejit, ada teori yang mengatakan "Kalo gak dpt anaknya....gebet emaknya" :D. Mungkin saja sih...karena 2 2 nya sama-sama tambang nickel, kalau misalnya ANTM bisa untung apalagi INCO yang notabene lebih besar dari ANTM produksi nickel nya ;)...jadi untuk antisipasi lap keu INCO, para spekulan masuk terlebih dahulu...smart move ;)

Ada juga teori yang mengatakan karena INCO sudah mencapai batas psikologi di 7950, sehingga langsung berbondong-bondong pada masuk.

TLKM - BAD MOVE !!!

Jujur gw hanya pengandalkan teori "Buy On Rumors, Sell On News" + volume, jadi pre-opening

langsung sikat TLKM based on rumors, kemudian liat ANTM langsung memimpin volume

sikat pula dengan full limit komposisi 70% TLKM 30% ANTM.

why bad move ?? check the chart !!

keliatan sekali tgl 1/25/2008 TLKM mencoba untuk keluar dari fibo rebound level 23.6% dan yang terjadi adalah gagal total...kalo dilihat kebelakang lagi...terlihat 23.6% itu sepertinya susah untuk dilewati. Memang betul opening TLKM langsung gap up di 9300 artinya tepat di level 23.6%, seharusnya saat itu jgn langsung hajar kanan, tapi perhatikan dahulu apakah sentimen pasar bisa menahan di angka tersebut sampai kira² 30 menit kedepan.

ANTM - VOLUME

sekali lagi Volume memang tidak pernah bohong ;) setelah kemarin BUMI sekarang ANTM dengan volume yang cukup besar, ditambah baru saja ngelirik milis ada berita Lap Keu ANTM menambah kecepatan akselerasi kenaikan ANTM. Hari ini netting 3725 - 3850 sesi 1. Di sesi 2 ga mau ambil resiko karena laporan inflasi Indonesia akan dikeluarkan BI. Betul...saat berita tersebut keluar dan meleset dari prediksi hingga 0.6% index langsung anjlok hingga -13, tapi kejadian penurunan itu hanya seperti shock therapy saja...index melangsungkan rally nya hingga di tutup menguat tipis ;). Menguatnya index dibantu oleh sentimen pasar terharap ANTM yang trus di buru oleh buyer...hingga mencapai 3900.

FENOMENA INCO

Lucu sekali, saat menjelang penutupan. saham INCO tiba² melejit, ada teori yang mengatakan "Kalo gak dpt anaknya....gebet emaknya" :D. Mungkin saja sih...karena 2 2 nya sama-sama tambang nickel, kalau misalnya ANTM bisa untung apalagi INCO yang notabene lebih besar dari ANTM produksi nickel nya ;)...jadi untuk antisipasi lap keu INCO, para spekulan masuk terlebih dahulu...smart move ;)

Ada juga teori yang mengatakan karena INCO sudah mencapai batas psikologi di 7950, sehingga langsung berbondong-bondong pada masuk.

The Doji

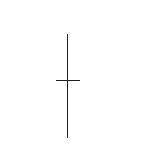

DOJI STAR

The Doji is also comprised of one candle. The Japanese say when a Doji occurs, one should always take notice. It is one of the most important Candlestick signals. The formation is created when the opening price and closing price are the same. This forms a horizontal line. The implication is that the bulls and the bears are in a state of indecision. It is an important alert at both the top and bottom of trends. At the top of a trend, the Doji signals a reversal without needing confirmation. The rule of thumb is that you should close a long or go short immediately.

However, the Doji occurring during the downtrend requires a bullish day to confirm the Doji day. The Japanese explanation is that the weight of the market can still force the trend downwards.

The Doji is an excellent example of the Candlestick method having superior attributes compared to the Western bar charting method. The deterioration of a trend is not going to be as apparent when viewing standard bar charts.

Criteria

1. The open and the close are the same or nearly the same.

2. The length of the shadow should not be excessively long, especially when viewed at the end of a bullish trend.

Signal Enhancements

1. A gap away from the previous day’s close sets up for a stronger reversal move.

2. Large volume on the signal day increases the chances that a blowoff day has occurred although it is not a necessity.

3. It is more effective after a long candle body, usually an exaggerated daily move compared to the normal daily trading range seen in the majority of the trend.

THE LONG LEGGED DOJI (JUJI)

The Long Legged Doji is comprised of long upper and lower shadows. The price opened and closed in the middle of the trading range. Throughout the day, the price moved up and down dramatically before it closed at or near the opening price. This reflects the great indecision that exists between the bulls and the bears. Juji means “cross.”

GRAVESTONE DOJI (TOHBA)

The Gravestone Doji is formed by the open and the close being at the low of the trading range. The price opens at the low of the day and rallies from there, but by the close the price is beaten back down to the opening price. The Japanese analogy is that it represents those who have

died in battle. The victories of the day are all lost by the end of the day. A Gravestone Doji, at the top of the trend, is a specific version of the Shooting Star. At the bottom, it is a variation of the Inverted Hammer. The Japanese sources claim that the Gravestone Doji can occur only on the ground, not in the air. This implication is that it works much better to show a bottom reversal than a top reversal. However, a Doji shows indecision no matter where it is found.

THE DOJI’S DRAGONFLY DOJI (TONBO)

The Dragonfly Doji occurs when trading opens, trades lower, and then closes at the open price that is the high of the day. At the top of the market, it becomes a variation of the Hanging Man. At the bottom of a trend, it becomes a specific Hammer. An extensively long shadow on a Dragonfly Doji at the bottom of a trend is very bullish. Dojis that occur in multiday patterns make those signals more convincing reversal signals.

The Doji is also comprised of one candle. The Japanese say when a Doji occurs, one should always take notice. It is one of the most important Candlestick signals. The formation is created when the opening price and closing price are the same. This forms a horizontal line. The implication is that the bulls and the bears are in a state of indecision. It is an important alert at both the top and bottom of trends. At the top of a trend, the Doji signals a reversal without needing confirmation. The rule of thumb is that you should close a long or go short immediately.

However, the Doji occurring during the downtrend requires a bullish day to confirm the Doji day. The Japanese explanation is that the weight of the market can still force the trend downwards.

The Doji is an excellent example of the Candlestick method having superior attributes compared to the Western bar charting method. The deterioration of a trend is not going to be as apparent when viewing standard bar charts.

Criteria

1. The open and the close are the same or nearly the same.

2. The length of the shadow should not be excessively long, especially when viewed at the end of a bullish trend.

Signal Enhancements

1. A gap away from the previous day’s close sets up for a stronger reversal move.

2. Large volume on the signal day increases the chances that a blowoff day has occurred although it is not a necessity.

3. It is more effective after a long candle body, usually an exaggerated daily move compared to the normal daily trading range seen in the majority of the trend.

THE LONG LEGGED DOJI (JUJI)

The Long Legged Doji is comprised of long upper and lower shadows. The price opened and closed in the middle of the trading range. Throughout the day, the price moved up and down dramatically before it closed at or near the opening price. This reflects the great indecision that exists between the bulls and the bears. Juji means “cross.”

GRAVESTONE DOJI (TOHBA)

The Gravestone Doji is formed by the open and the close being at the low of the trading range. The price opens at the low of the day and rallies from there, but by the close the price is beaten back down to the opening price. The Japanese analogy is that it represents those who have

died in battle. The victories of the day are all lost by the end of the day. A Gravestone Doji, at the top of the trend, is a specific version of the Shooting Star. At the bottom, it is a variation of the Inverted Hammer. The Japanese sources claim that the Gravestone Doji can occur only on the ground, not in the air. This implication is that it works much better to show a bottom reversal than a top reversal. However, a Doji shows indecision no matter where it is found.

THE DOJI’S DRAGONFLY DOJI (TONBO)

The Dragonfly Doji occurs when trading opens, trades lower, and then closes at the open price that is the high of the day. At the top of the market, it becomes a variation of the Hanging Man. At the bottom of a trend, it becomes a specific Hammer. An extensively long shadow on a Dragonfly Doji at the bottom of a trend is very bullish. Dojis that occur in multiday patterns make those signals more convincing reversal signals.

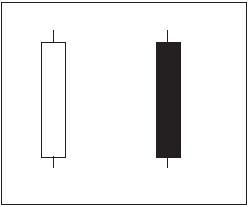

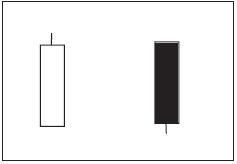

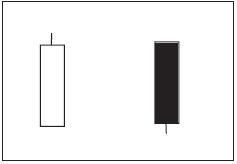

Candlestick Basic

The long day represents a large price move from open to close. Long represents the length of the candle body. What qualifies a candle body to be considered long? That is a question that has to be answered relative to the chart being analyzed. The recent price action of a stock determines

whether a long candle has been formed. Analysis of the previous two or three weeks of trading should be a current representative sample of the price action.

whether a long candle has been formed. Analysis of the previous two or three weeks of trading should be a current representative sample of the price action.

Short days can be interpreted by the same analytical process as used with the long candles. There is a large percentage of trading days that do not fall into either of these two categories.

Marubozu

In Japanese, Marubozu means close-cropped or close-cut. Bald or Shaven Head is more commonly used in Candlestick analysis. Its meaning reflects the fact that there are no shadows extending from either end of the body.

The long black body with no shadows at either end is known as a Black Marubozu. It is considered a weak indicator. It is often identified in a bearish continuation or bullish reversal pattern, especially if it occurs during a downtrend. A long black candle could represent the final

sell off, making it an alert to a bullish reversal setting up. The Japanese often call it the Major Yin or Marubozu of Yin.

sell off, making it an alert to a bullish reversal setting up. The Japanese often call it the Major Yin or Marubozu of Yin.

White Marubozu

The White Marubozu is a long white body with no shadowson either end. This is an extremely strong pattern. Consider how it is formed. It opens on the low and immediately heads up. It continues upward until it closes, on its high. Counter to the Black Marubozu, it is often the

first part of a bullish continuation pattern or bearish reversal pattern. It is called a Major Yang or Marubozu of Yang.

first part of a bullish continuation pattern or bearish reversal pattern. It is called a Major Yang or Marubozu of Yang.

Closing Marubozu

The Closing Marubozu has no shadow at its closing end. A white body does not have a shadow at the top. A black body does not have a shadow at the bottom. In both cases, these are strong signals corresponding to the direction that they each represent.

Opening Marubozu

The Opening Marubozu has no shadows extending from the open price end of the body. A white body would not have a shadow at the bottom end; the black candle would not have a shadow at its top end. Though these are strong signals, there are not as strong as the Closing Marubozu.

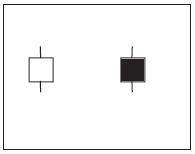

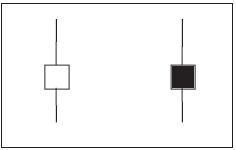

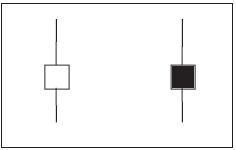

Spinning Top

Spinning Tops are depicted with small bodies relative to the shadows. This demonstrates some indecision on the part of the bulls and the bears. They are considered neutral when trading in a sideways market. However, in a trending or oscillating market, a relatively good rule of

thumb is that the next day’s trading will probably move in the direction of the opening price. The size of the shadow is not as important as the size of the body for forming a Spinning Top.

thumb is that the next day’s trading will probably move in the direction of the opening price. The size of the shadow is not as important as the size of the body for forming a Spinning Top.

Subscribe to:

Posts (Atom)